- Weak demand for ETH seen amid Ethereum ETF outflows, signaling waning investor interest.

- Despite Open Interest decline, top traders remain bullish, hinting at a potential market shift.

Recent data shows continuous outflows in Ethereum [ETH] ETFs, contradicting earlier expectations of increased demand through ETFs.

Analysts point to these outflows as a possible cause for ETH’s bearish trend in recent times.

Wu Blockchain reported a peak in Ethereum spot ETF net outflows at $15.114 million on September 17th.

Further data from Ethereum ETFs indicated predominant outflows rather than inflows throughout the week.

These outflows have likely impacted ETH’s performance, leading to subdued sentiment and reduced network activity.

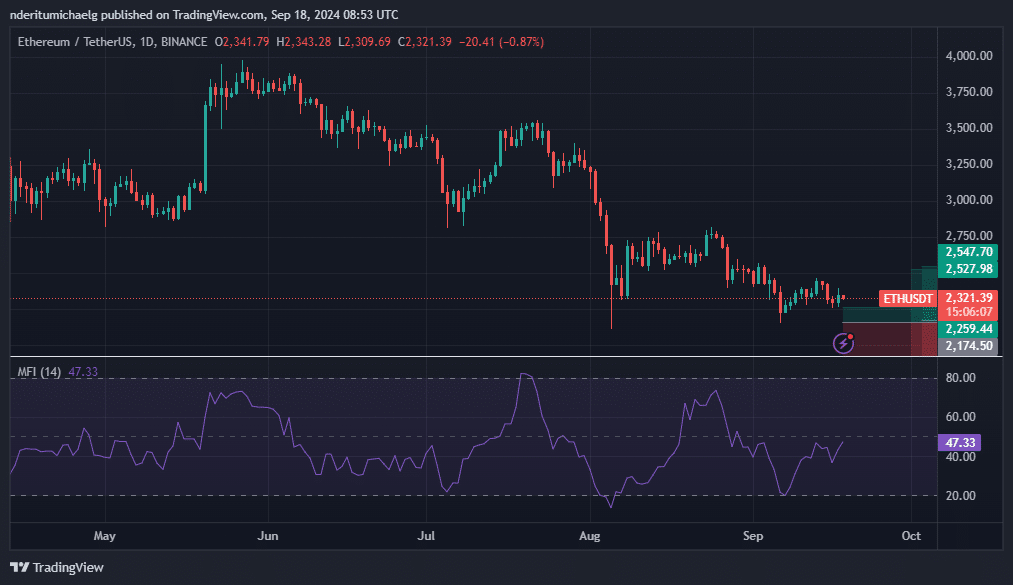

ETH’s recent price movement reflects this lack of demand, with the cryptocurrency trading at $2,321 at the time of writing.

Source: TradingView

ETH’s Relative Strength Index (RSI) struggles to surpass the 50% mark, confirming weak bullish momentum. Despite this, the Money Flow Index (MFI) suggests some ongoing liquidity inflow, albeit in small amounts.

Can ETH Stage a Strong Recovery?

A substantial rally remains a possibility. ETH’s current challenges stem from various factors, including ETF outflows and limited on-chain activity.

A turnaround in these factors could reignite demand, especially if Ethereum ETFs start attracting healthy inflows.

While ETH’s current price level may be considered a support zone, uncertainty persists, affecting its performance even in the derivatives market.

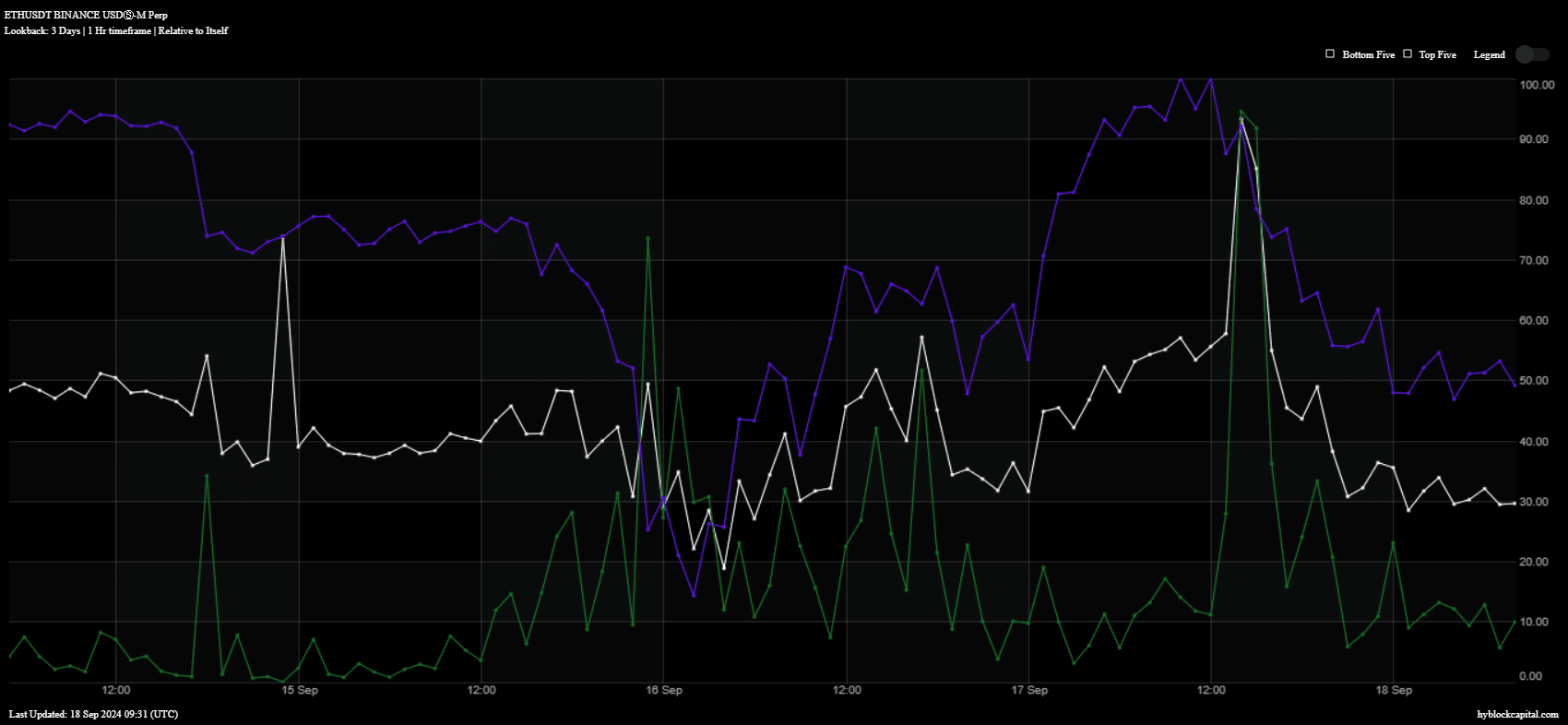

Source: Hyblock Capital

Recent trends suggest that whales may be influencing ETH’s performance, with a decrease in long positions among top traders followed by a subsequent increase, indicating a shift towards a bullish sentiment.

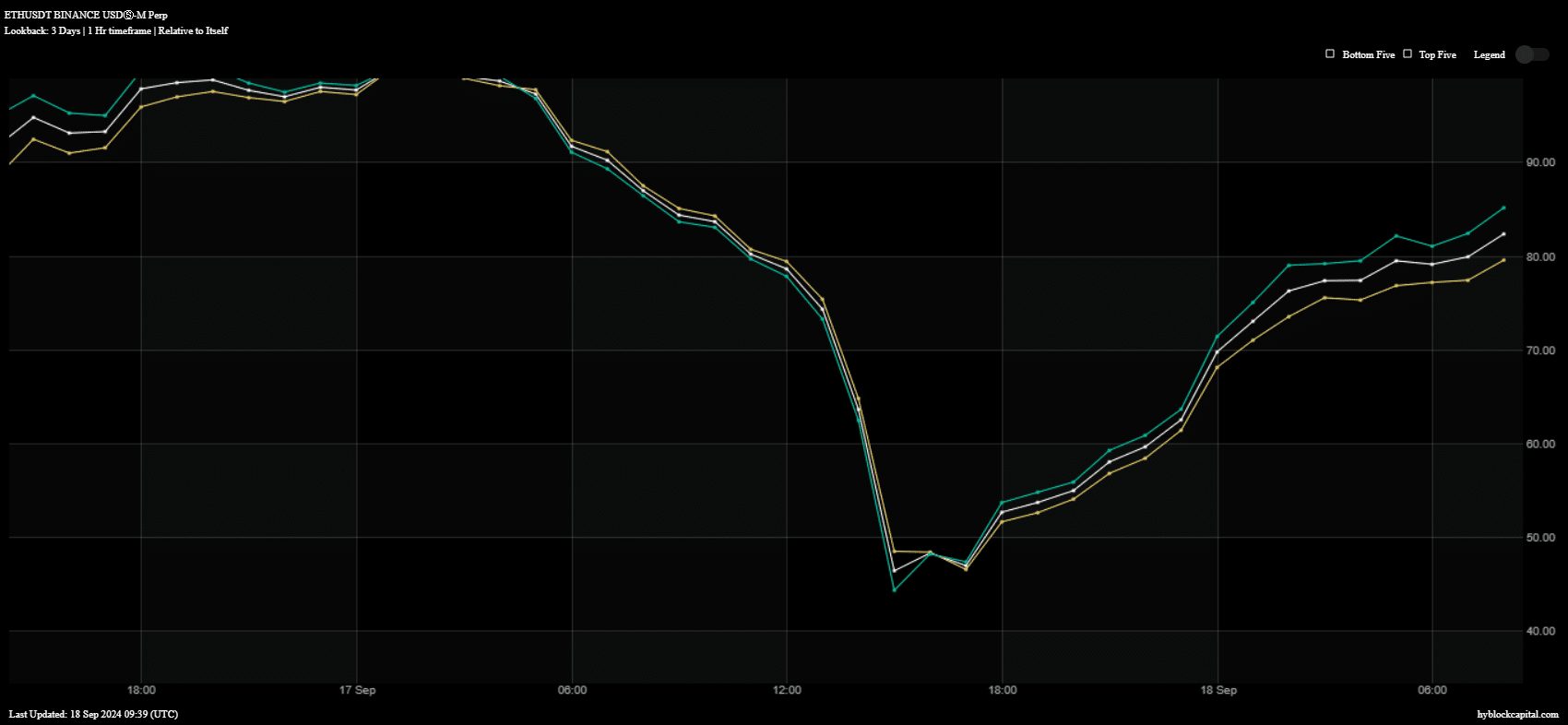

Source: Hyblock Capital

Read Ethereum’s [ETH] Price Prediction 2024–2025

Long positions among top addresses and globally have rebounded significantly in the past 24 hours, suggesting potential bullish momentum for ETH in the coming days.

However, the extent of this rally will depend on ETH’s ability to generate enough demand and momentum to push its price higher.

sentence: Please make sure to lock the door before leaving the house.