A recent survey conducted by Raleigh Realty sheds light on the challenges faced by 1,000 first-time homebuyers as they navigate the housing market. The survey reveals that rising housing prices, high interest rates, and market uncertainty have made it difficult for newcomers to enter the market. Many buyers find themselves stretching their budgets or compromising on their lifestyle in order to purchase a home.

There is a notable generational divide in homeownership, with the majority of first-time buyers being Gen X or Baby Boomers. In contrast, only 4% of buyers belong to Gen Z. Younger adults, especially Gen Z, face high barriers to entry, with 63% of Gen Z buyers earning more than $75,000 annually. This contrasts with Baby Boomers, who were able to purchase their first homes with lower incomes, indicating a decrease in affordability over time.

Income continues to play a significant role in access to homeownership. While many first-time buyers earn between $50,000 and $75,000, a considerable number earn less, especially among older generations. Gen Z buyers, in particular, have relatively few individuals earning below $50,000. This trend reflects the financial concerns of younger individuals who grew up during the 2008 housing crash and entered adulthood during economic uncertainty.

The rise of flexible work arrangements has influenced home buying decisions, with a third of first-time buyers working remotely or in hybrid roles. This flexibility allows buyers to relocate in search of more affordable housing or a better quality of life. Gen Z leads in the adoption of remote work, with over 40% working fully in-office, while Baby Boomers are more likely to rely on retirement income or alternative sources of income.

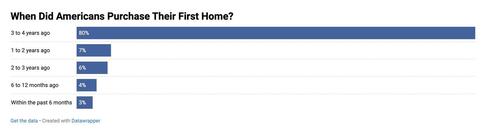

Despite reports of falling housing prices in the media, few first-time buyers made purchases in the last year. Most buyers acquired their homes three to four years ago, during or shortly after the pandemic housing surge. The decrease in home sales in 2023 reflects broader economic conditions such as high inflation and reduced affordability.

Single-family homes remain the top choice among first-time buyers, with 90% opting for this housing option regardless of income level. Even those earning less than $50,000 prefer standalone houses over condos or multi-family units. However, most buyers choose existing homes over new construction, likely due to cost or availability.

Many buyers embarked on the journey into homeownership either solo or as a couple, with half of respondents being married and 40% being single. Only a small percentage of buyers purchased homes with friends, siblings, or unmarried partners, reflecting traditional patterns of household formation and financial independence.

The majority of buyers moved quickly once they started their home search, with about 70% closing on a property within six months and 35% finding a home in three months or less. However, the speed of the process did not alleviate stress, as 90% of first-time buyers found the experience challenging. Affordability was cited as the top source of stress, outweighing concerns about mortgage approval, taxes, or maintenance.

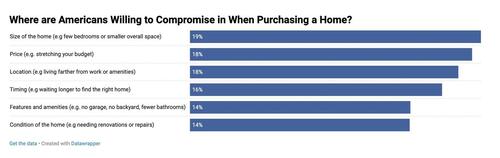

Financial constraints led many buyers to make compromises, with nearly one in five settling for smaller homes, less desirable locations, or properties in need of repairs. Going over budget was a common trade-off, with Baby Boomers being the most willing to exceed their budget, while Gen Z buyers were more likely to compromise on location.

Concerns about job stability were prevalent among buyers, with more than half expressing worries about making mortgage payments if they were to lose their job. Gen Z and Millennials showed the highest levels of anxiety in this regard, while Baby Boomers exhibited more confidence in their financial resilience, likely due to retirement savings or owning their homes outright.

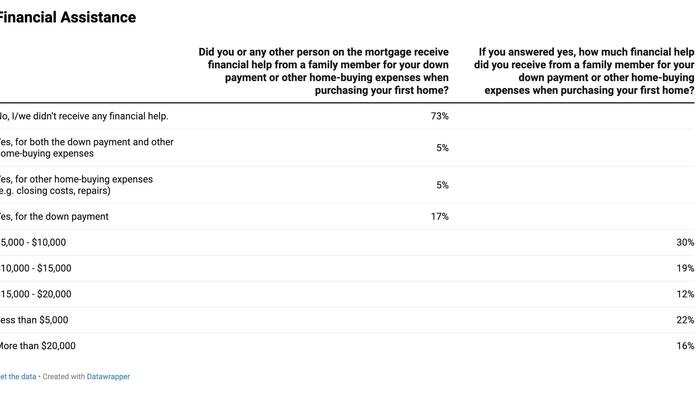

Contrary to common assumptions, the majority of first-time buyers did not receive financial assistance. Approximately 73% of buyers funded their home purchases without help from family. Among those who did receive assistance, contributions varied, with 52% receiving $10,000 or less. Only 16% received over $20,000, and a small percentage received aid from government programs.

The report from Raleigh Realty highlights that while mortgage approval is a common concern, most buyers did not apply for financing until after they began their home search. Over half of buyers applied to only one lender, with interest rates being a primary consideration for lender selection. Some buyers chose lenders they were already familiar with or those recommended by real estate agents.

Despite the financial challenges, the majority of buyers expressed satisfaction after purchasing a home. While only 12% considered their purchase to be their dream home, 73% felt that homeownership brought them closer to achieving the American dream. Buyers with lower incomes tended to report higher levels of satisfaction, possibly due to more modest expectations.

Only a small percentage of first-time buyers plan to sell their homes in the near future, with 9% expecting to do so within five years and nearly half planning to stay for at least a decade. The majority of buyers have a long-term mindset, with 30% intending to remain in their homes for 20 years or more.

Post-purchase home improvement is a common goal among buyers, with around 60% planning to invest $1,000 to $10,000 in upgrades during the first year. Additionally, nearly one in three buyers plan to spend even more on home improvements. These projects are viewed as essential for adding value to the property or addressing compromises made during the purchasing process.

Youthful buyers are more likely to explore income-generating strategies, with approximately 40% of Gen Z and 30% of Millennials taking on second jobs to manage homeownership costs. Many buyers also rent out parts of their property or utilize short-term rental platforms. In contrast, only 14% of Baby Boomers supplement their income in this manner.

Emergency savings are more prevalent among first-time buyers compared to the general population, with around 79% of buyers reporting having some form of savings. Most buyers have savings exceeding $1,000, and 17% have saved over $20,000. Younger buyers may be more inclined to save due to concerns about job security and economic instability.

In conclusion, the complete survey results emphasize that while homeownership remains a significant milestone, today’s first-time buyers are navigating a challenging and intricate landscape. Income, generational experiences, and work flexibility all play a role in shaping outcomes, and many buyers are willing to make sacrifices in order to achieve the goal of owning a home.

Loading…