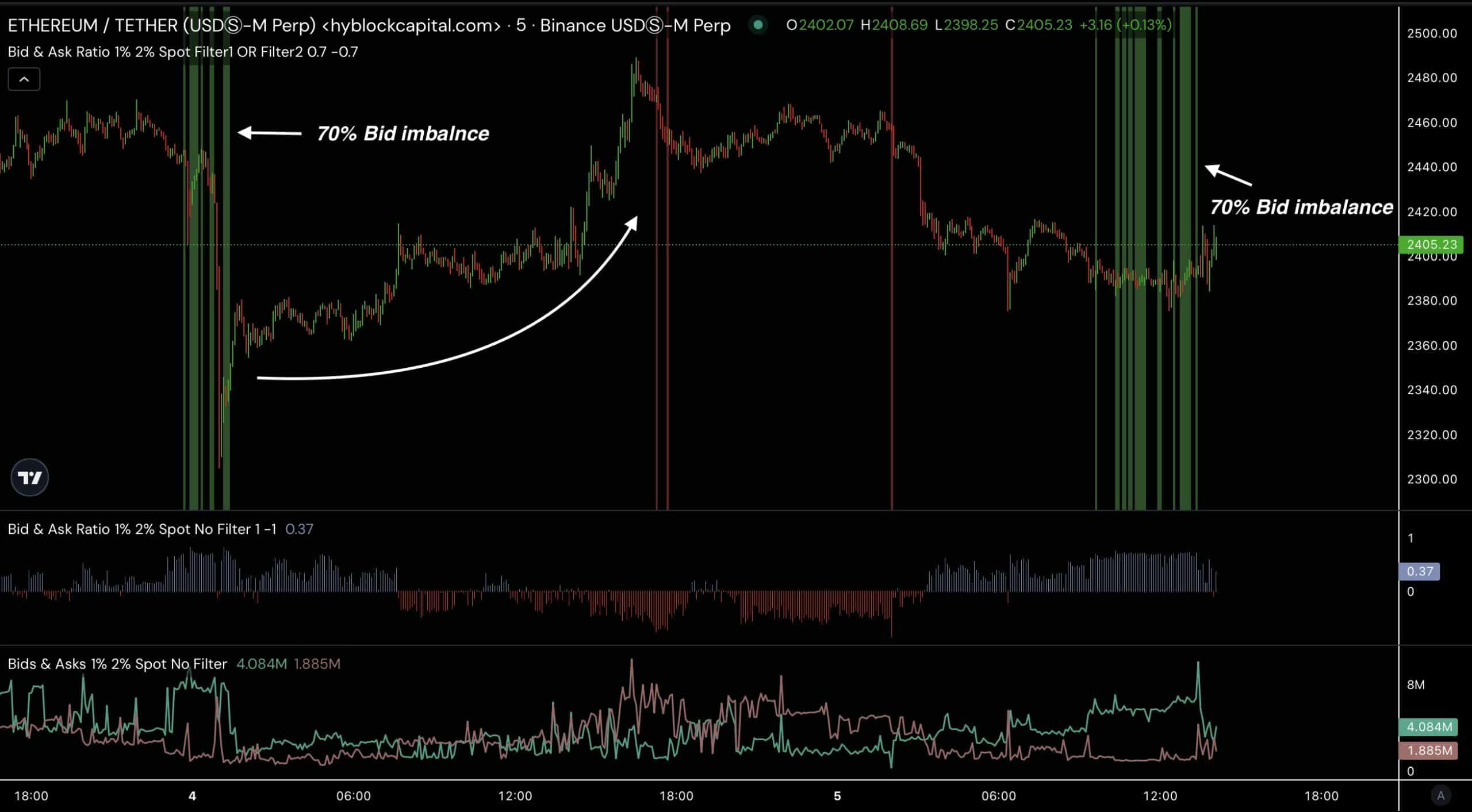

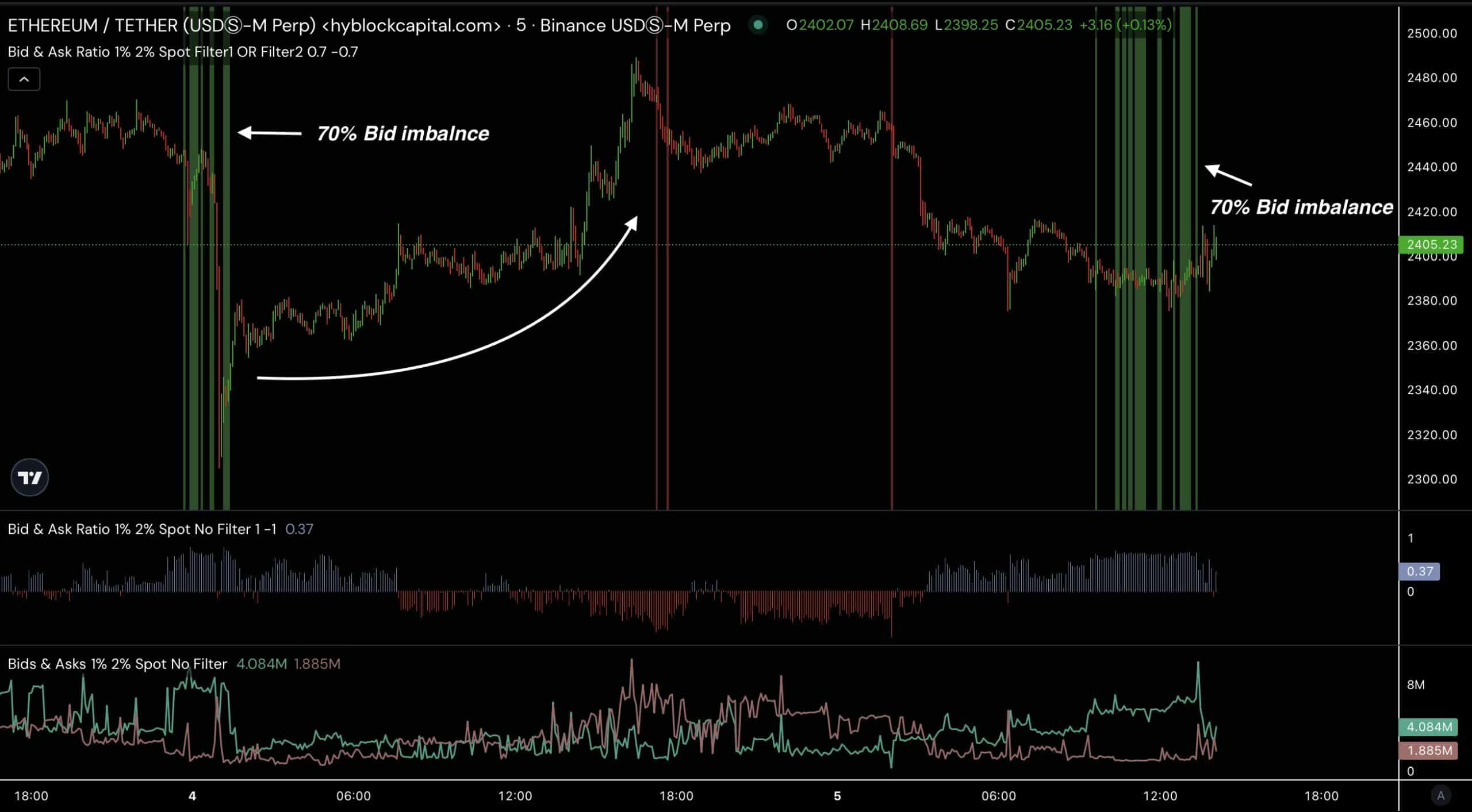

- Currently, the orderbook imbalance for ETH stands at 70%

- There is speculation that Ethereum might reach new highs in the near future

Despite Bitcoin hitting an all-time high earlier this year, Ethereum has failed to follow suit, leading to concerns about its momentum. However, recent data on the ETH/USDT pair is offering hope to Ethereum supporters.

Hyblock Capital’s data shows a significant 70% orderbook imbalance for ETH at a 1-2% depth. Historically, when ETH experiences a similar bid imbalance, it tends to mark a bottom and start moving upwards.

The current bid imbalance suggests that ETH could potentially see a similar upward trend in its price.

Source: Hyblock Capital

Ethereum’s Potential in an Ascending Triangle

At the moment, Ethereum seems to be forming an ascending triangle pattern on the weekly chart, with its price respecting the 200-moving average.

This consolidation pattern typically indicates a bullish outlook for ETH, as ascending triangles often precede price breakouts.

The 70% bid imbalance further supports the possibility of an upward movement in Ethereum’s price.

Source: TradingView

Consolidation phases often precede significant price movements, and a breakout could potentially propel ETH to higher price levels.

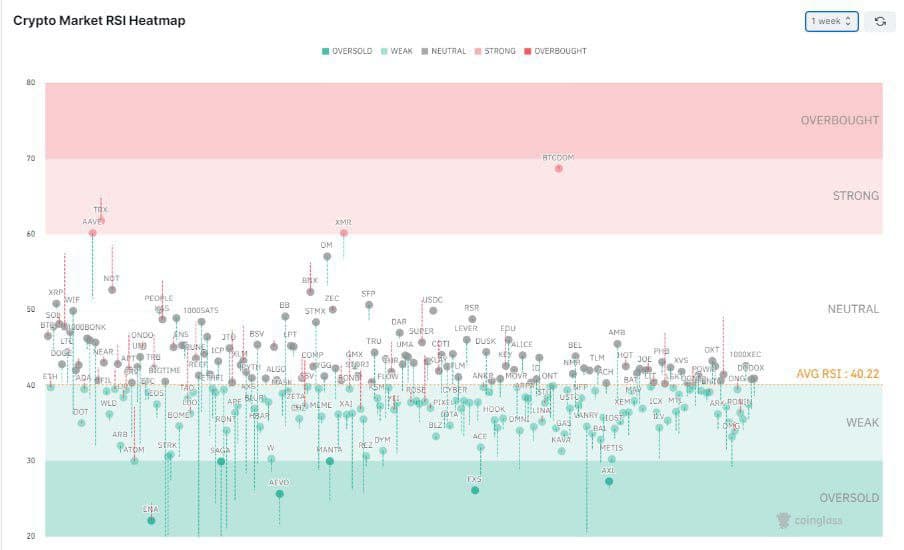

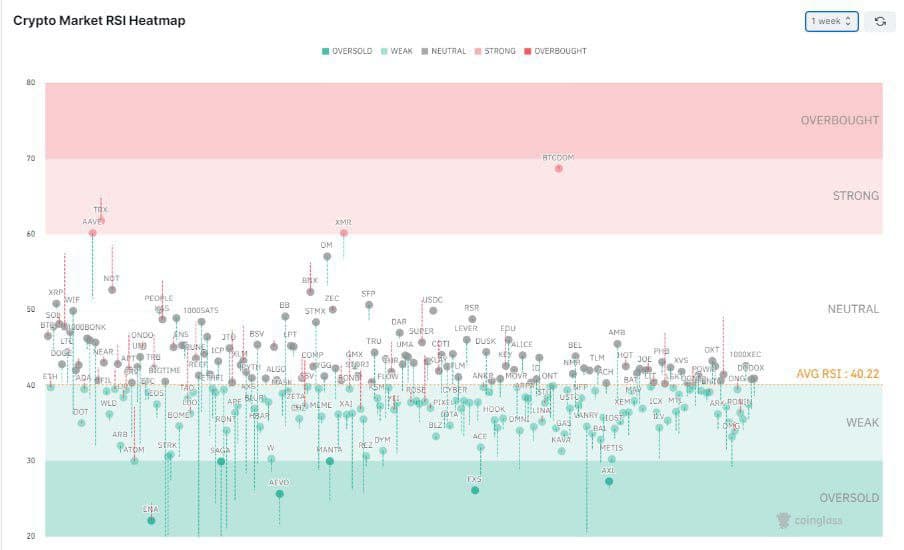

Weekly RSI Heatmap Analysis

The weekly Relative Strength Index (RSI) heatmap indicates that many cryptocurrencies are currently in a weak or neutral zone, with an average RSI of 40.22%.

This transition from oversold conditions to more neutral levels suggests a possible upward movement for ETH.

Source: Coinglass

With the RSI trending towards more neutral levels and the bid imbalance indicating a potential bottom, there is a possibility of a price surge for ETH in the near future.

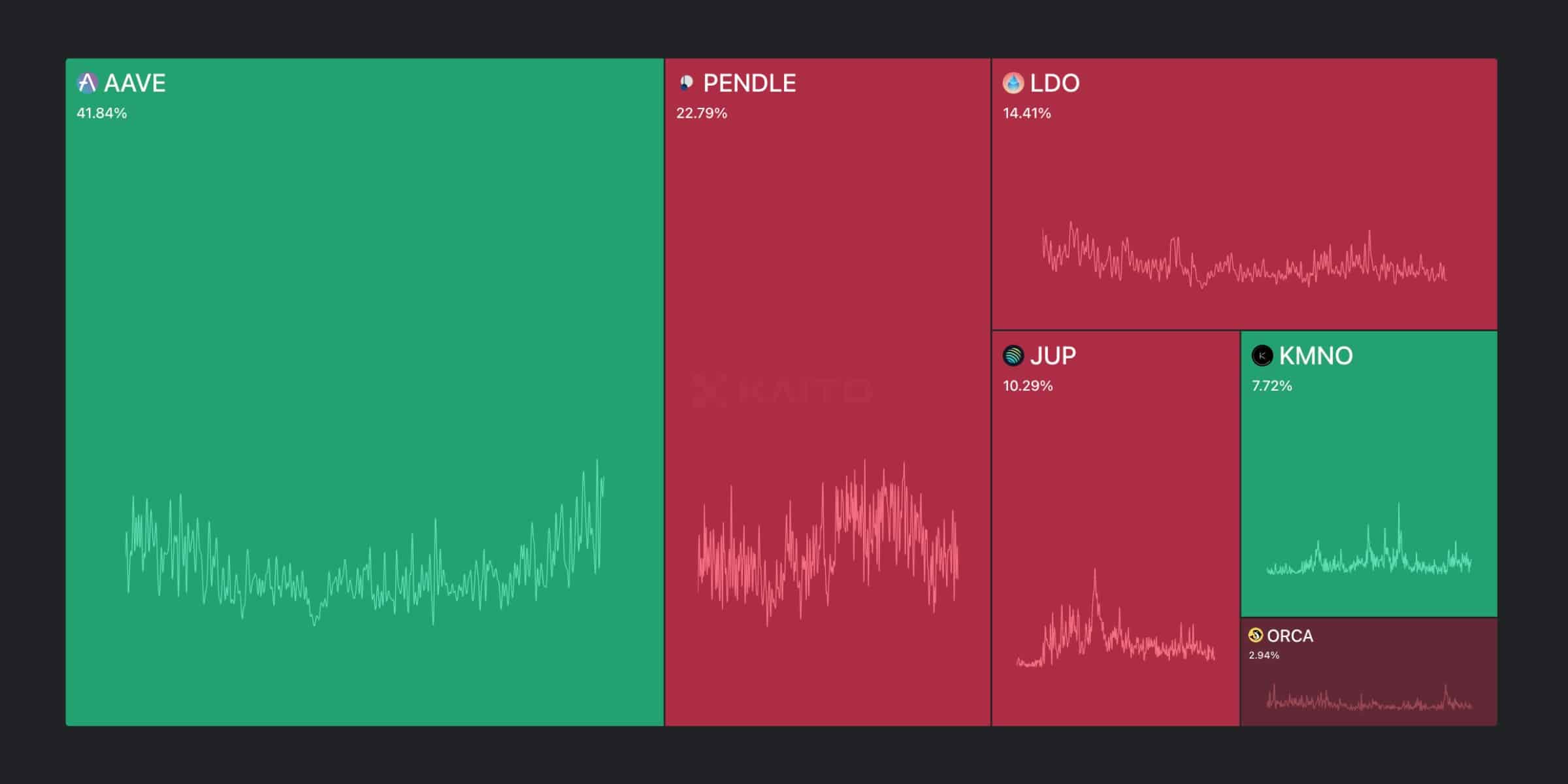

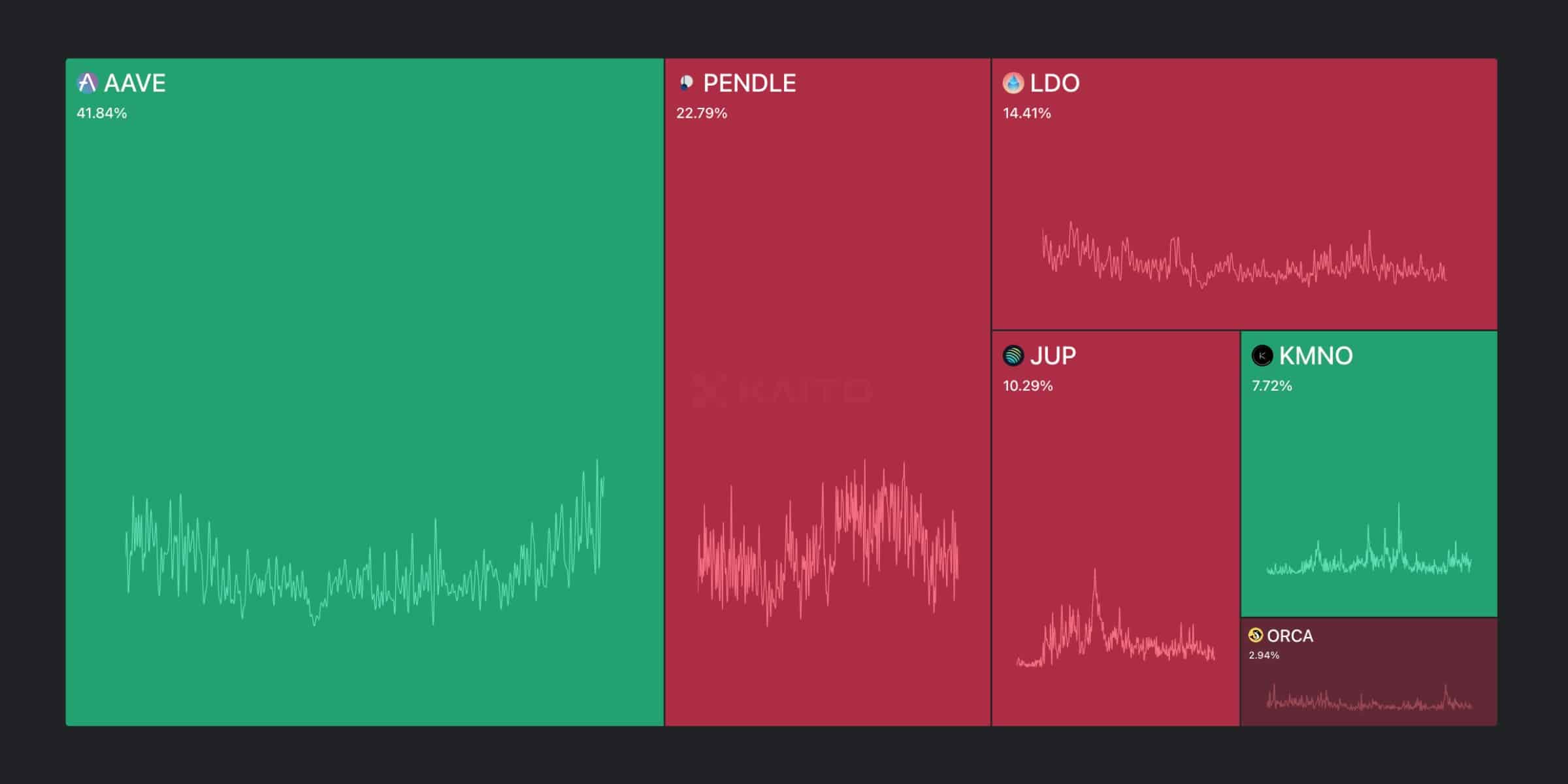

Booming ETH-Based Protocols

Vitalik Buterin, the co-founder of Ethereum, recently announced his plans to donate his Layer 2 (L2) and project tokens to support public goods and charitable causes within the ETH ecosystem.

This move not only strengthens Ethereum’s long-term prospects but also solidifies its position in the decentralized finance (DeFi) sector. Despite competition from other platforms like Solana, Ethereum remains a dominant force in DeFi, according to analysts at Kaito AI.

Source: KaitoAI

Key DeFi platforms like Aave, Pendle, and Lido operate on Ethereum, indicating further adoption of ETH and potential price appreciation.

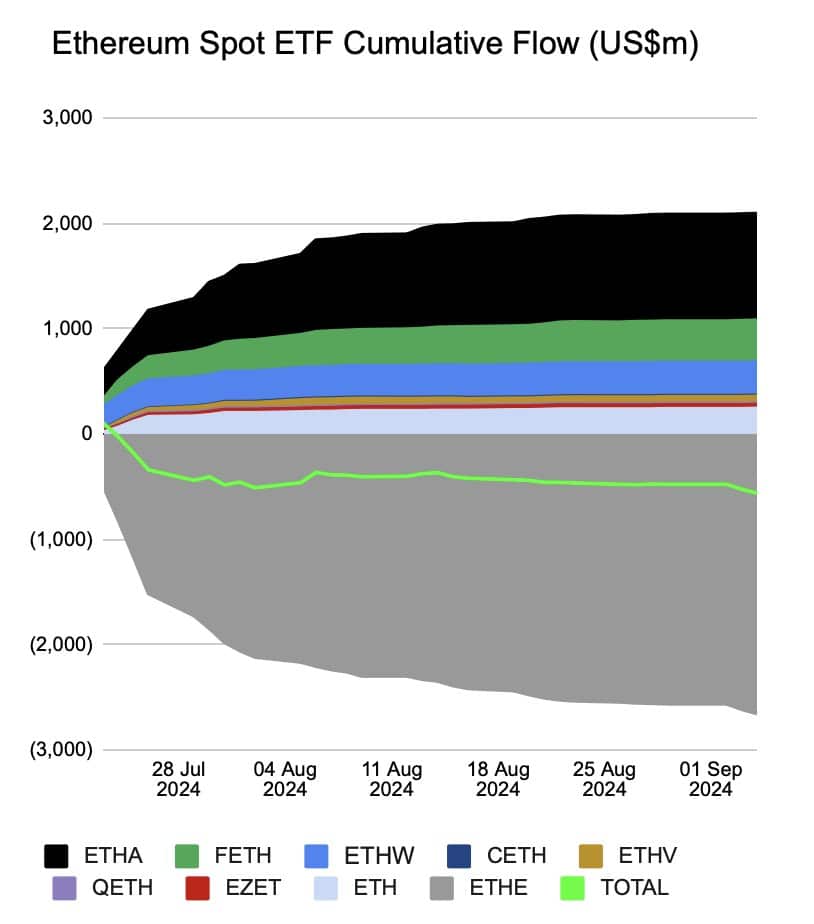

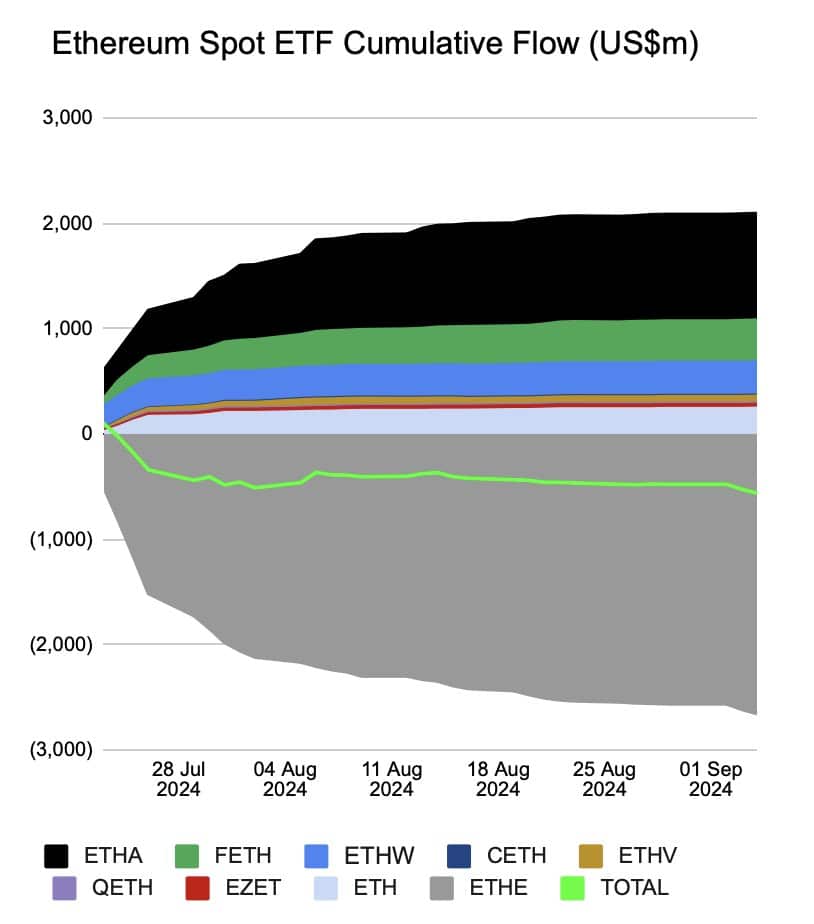

Concerns about Ethereum ETF Flows

Despite Ethereum-based ETFs being a positive development for the cryptocurrency, recent data shows that cumulative flows in these ETFs have hit an all-time low with net outflows of $562.3 million.

The lack of demand for ETH ETFs poses a risk to the market, as some issuers may consider closing their products if demand does not pick up.

Source: X

Despite this concern, ongoing developments in the Ethereum ecosystem suggest a potential price turnaround in the near future.

original sentence:

The cat sat lazily in the sun, grooming its fur with careful precision.

Rewritten sentence:

Basking in the sunlight, the cat lazily groomed its fur with meticulous care.