Over the past couple of years, it appeared that the Federal Reserve’s pattern of raising interest rates had been turned upside down, with Erdoganomics taking the reins. Despite tighter financial conditions, home prices continued to surge upward. This trend was fueled by a limited pool of wealthy buyers, rendering mortgages unnecessary.

However, prolonged tightening eventually takes its toll even on the wealthiest segments of society. This is evident in the US housing market, which serves as a critical indicator of the overall economy, particularly for the middle class. The latest Case Shiller data revealed the first year-over-year decline in the Composite 20 city index since early 2023…

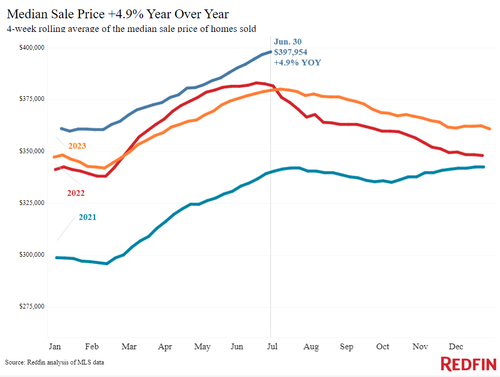

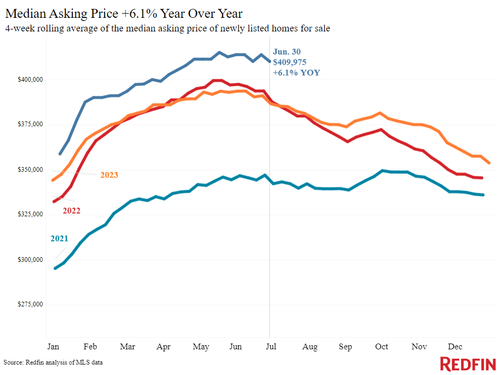

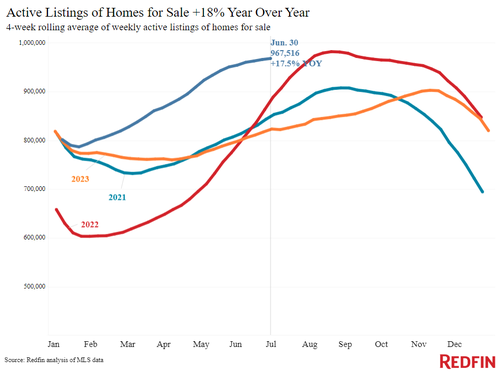

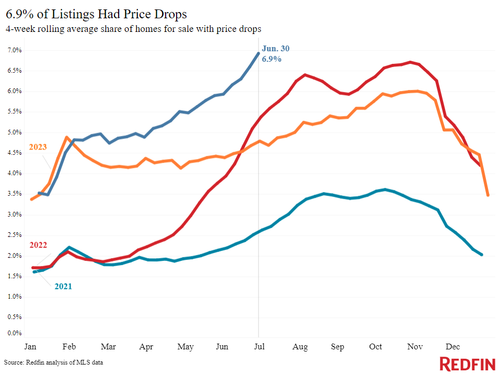

…and the trend is further exemplified in the latest Redfin home price data. Notably, while average home sale prices reached new highs, actual transactions plummeted. Additionally, the number of new listings surged, and the record number of price drops indicated the struggle of homeowners trying to extract value from their properties within an increasingly volatile market.

Here are the specifics:

The median sale price hit a record high of $397,954, marking a 4.9% year-over-year increase, the largest since March.

Simultaneously, the median asking price rose to $409,975, with a 6.1% year-over-year increase, the most significant jump since October 2022.

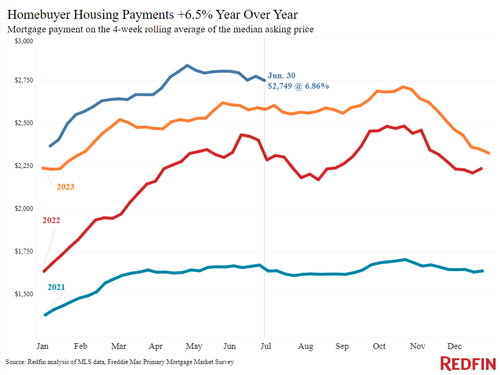

However, the plateauing of asking prices indicates a shrinking pool of potential buyers who can afford the exorbitant costs. With sellers reluctant to lower prices, transactions have plummeted, contributing to a market standstill.

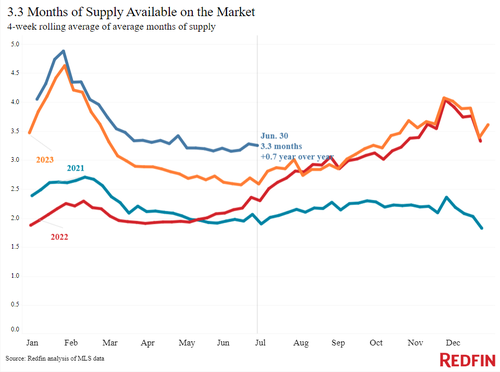

As a result, the number of active home listings has surged by 18% year over year, leading to an inventory glut…

…resulting in a record 3.3 months of supply for this time of year.

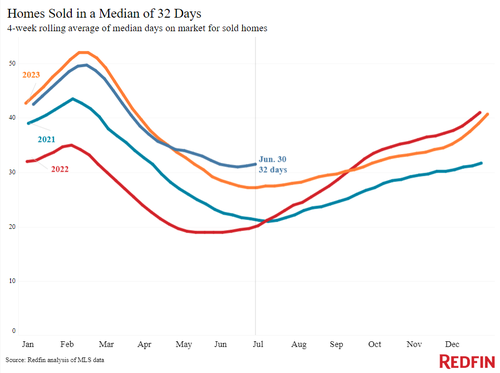

This oversupply has led to prolonged median home sale durations…

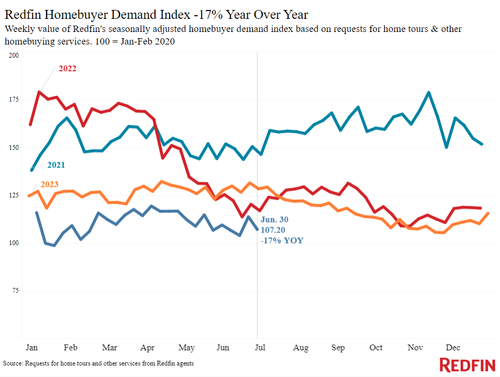

…amid a 17% year-over-year decline in demand.

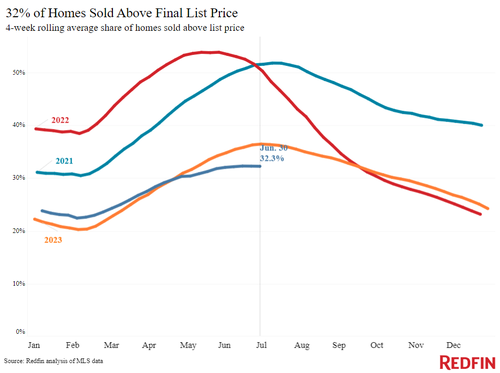

As sellers grow increasingly impatient, the percentage of homes sold above listing price has plummeted from a record 55% to just 32.3%.

Most notably, sellers are beginning to lower prices, exemplified by a record 6.9% surge in listings with price drops.

Unless the Federal Reserve enacts significant rate cuts in the coming months, the housing market is poised to enter a self-reinforcing liquidation spiral. This scenario could lead to a full-fledged housing crash, coinciding with the tenure of the next presidential administration.

Loading…