The Reawakening of a Bitcoin Whale: A Bold Bet on Ethereum’s Potential

A bitcoin wallet that lay dormant for seven years has sprung back to life, making significant moves by selling a large portion of its BTC holdings and investing in Ethereum.

According to a report by CoinTelegraph, a wealthy Bitcoin whale worth over $11 billion has recently closed out substantial Ether long positions and shifted funds into spot Ether, amounting to hundreds of millions of dollars. This move suggests that major investors are anticipating further growth in the value of the second-largest cryptocurrency in the world.

Last week, the Bitcoin whale in question sold 22,769 Bitcoin, valued at $2.59 billion, and reinvested the proceeds into 472,920 spot Ether, totaling $2.2 billion, along with a $577 million Ether perpetual long position on the decentralized exchange Hyperliquid.

Further actions by the whale included closing a $450 million perpetual long position in Ether at an average price of $4,735 to secure a $33 million profit, followed by acquiring an additional $108 million worth of spot Ether. As reported by blockchain intelligence platform Lookonchain, the whale still holds 40,212 Ether longs, with an unrealized profit exceeding $11 million.

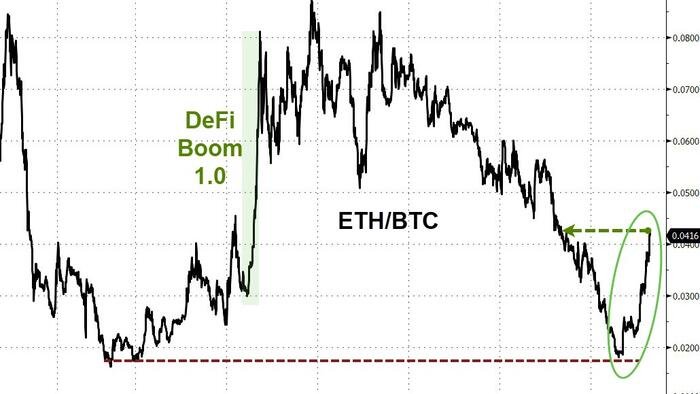

The surge in demand for Ether among whales has been on the rise over the past month, as Ether’s price has seen a 25% increase, outperforming Bitcoin’s 5.3% decline over the same period, according to TradingView data.

Analysts attribute last week’s dip in Bitcoin’s price to whale rotations, with large investors selling off Bitcoin to increase their exposure to Ethereum, thereby boosting Ether’s momentum.

While Bitcoin may experience a lack of momentum in the coming weeks, it is expected to trade within a range of $110,000-$120,000. On the other hand, Ethereum is showing strength, with potential targets between $4,600 and $5,200, signaling the onset of a possible altcoin season.

Federal Reserve Chair Jerome Powell’s recent dovish comments have acted as a catalyst for boosting risk appetite among crypto investors, leading to capital rotation from Bitcoin to Ethereum, further propelling Ether’s upward trajectory.

Despite Ether’s rally of over 300% in the past four months, whales continue to show aggressive appetite for the cryptocurrency, indicating that the rally may not have reached its peak yet.

In contrast, Strategy, the world’s largest public Bitcoin holder, has been stockpiling more BTC during price dips, with its total Bitcoin holdings now exceeding 632,000 BTC, purchased at an average price of $73,527 per coin. Strategy’s co-founder, Michael Saylor, has expressed a preference for buying Bitcoin at higher prices, emphasizing Bitcoin as the ultimate exit strategy.

Overall, these recent developments highlight the shifting dynamics in the cryptocurrency market, with whales making bold moves and reshaping the landscape of digital asset investments.