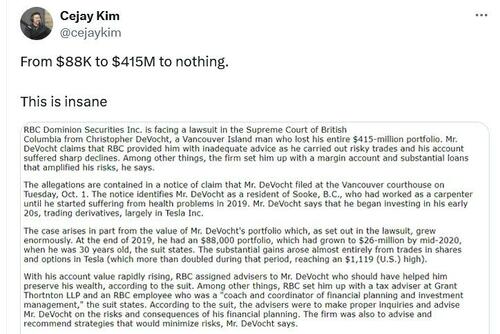

A Man Loses $415 Million in Stock Market, Sues Advisors for Negligence

Authored by Brayden Lindrea via CoinTelegraph.com

A man who managed to turn $88,000 into a staggering $415 million before losing it all has filed a lawsuit against his investment firm and advisers. He claims they failed to provide adequate advice while he engaged in risky trading activities.

Christopher DeVocht alleges that RBC Dominion Securities facilitated a margin account and significant loans that ultimately led to the collapse of his entire investment portfolio. Stockwatch reported on Oct. 3 about the lawsuit.

DeVocht accumulated his wealth primarily through trading shares and utilizing Tesla options. He then enlisted the services of RBC, who assigned advisers to help him safeguard his wealth by recommending risk management strategies.

DeVocht’s portfolio reached a peak of $415 million on Nov. 30, 2021, but suffered a rapid decline in 2022 amidst the crash of Tesla and the broader stock market. He was forced to sell off Tesla shares and repay loans, leading to the depletion of his entire net worth.

According to DeVocht, the losses incurred were partly due to the inadequate advice provided by RBC and Grant Thornton LLP. He claims that had he received better guidance, he could have preserved a substantial portion of his wealth.

“But for the defendants’ inadequate advice … the plaintiffs would have preserved a substantial portion of their wealth and implemented financial planning that would not have resulted in the loss of their entire net worth.”

While this case pertains to traditional stocks, it serves as a reminder that such incidents are not exclusive to the crypto markets, as highlighted by user Kun to his followers.

DeVocht is now seeking court-ordered damages, along with legal costs and interest, from RBC Wealth Management Financial Services and Thornton. The lawsuit has been filed in the Supreme Court of British Columbia in Canada, with the defendants yet to respond.

Loading…