The discrepancy arises from how cost-of-living adjustments (COLAs) are calculated. Currently, the Social Security Administration (SSA) determines annual increases based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which focuses on the spending patterns of younger, urban workers.

Alternatively, the Consumer Price Index for the Elderly (CPI-E) places greater emphasis on housing, healthcare, and utilities. According to Investopedia, using the CPI-E would have resulted in a 3.1% increase in 2026 instead of the 2.8% based on the CPI-W.

In the past three years, COLAs based on the CPI-W have consistently fallen behind those calculated using the CPI-E, trailing by an average of 0.2% annually over 18 of the last 26 years. This has led to retirees’ annual raises not keeping pace with the inflation of their essential expenses.

Even if the calculation method shifts to the CPI-E, the rising costs of Medicare could offset some of the gains, as highlighted by Newsweek. Medicare Part B premiums are projected to increase from $185 to $202.90 in 2026, diminishing the impact of COLA increases on benefits.

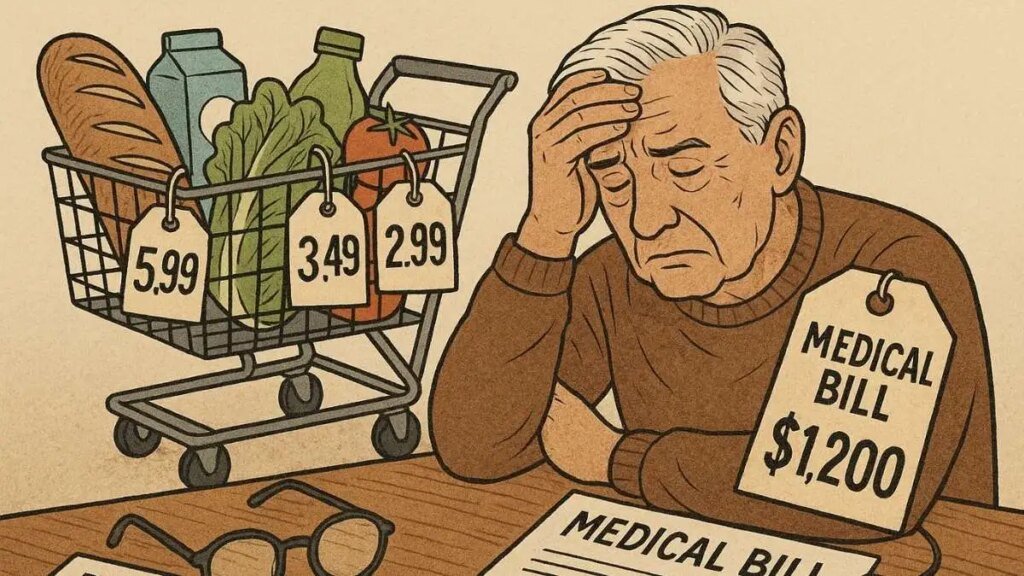

Social Security benefits have increasingly failed to keep up with inflation. While the majority of cost-of-living adjustments outpaced inflation in the 1990s and 2000s, only 20% did so in the early 2020s, aside from the 8.7% surge in 2023 due to pandemic-related inflation.

The Senior Citizens League (TSCL) estimates that retirees who began receiving benefits in 1999 have missed out on nearly $5,000 in lifetime payments compared to what they would have received under the CPI-E. For those retiring in 2024, the shortfall could exceed $12,000 over a 25-year retirement.

TSCL also suggests that Social Security benefits have lost around 20% of their value since 2010. To fully restore their purchasing power, retirees would require an additional $370 per month, equivalent to $4,440 annually.

Congress has put forth two bills to bridge this gap, as any alteration to the COLA calculation necessitates a change in federal legislation.

The Boosting Benefits and COLAs for Seniors Act aims to revamp the method of determining annual adjustments, while the Social Security Emergency Inflation Relief Act proposes a temporary $200 monthly increase in benefits until July 2026.

According to Newsweek, these initiatives are supported by Democratic Senators Elizabeth Warren, Kirsten Gillibrand, Ron Wyden, and Chuck Schumer, among others.