- Solana’s market dominance over Ethereum has surged recently, indicating a shift in traction towards SOL.

- This increase can be attributed to the rise in transactions and network activity on Solana.

Over the past month, Solana [SOL] and Ethereum [ETH] have shown different performances, with SOL gaining 3.45% while ETH dropped 14.37%, solidifying SOL’s lead.

However, there are deeper reasons behind Solana’s recent dominance over Ethereum, impacting their future price movements.

Breaking Records and Increasing Interest

In the last 24 hours, the SOL/ETH chart closed above $0.08043, reaching an all-time high and attracting more capital towards Solana.

Source: TradingView

The trend indicates a shift in investment from ETH to SOL, hinting at expectations of better performance from Solana in the near future.

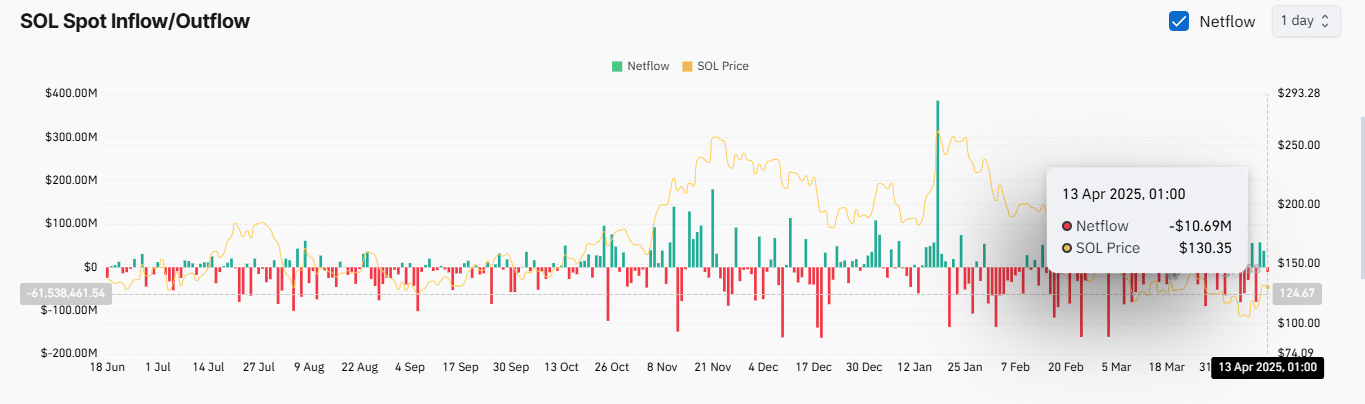

Artemis’ data on liquidity flow supports this transition, with Solana receiving a positive net inflow of $25.4 million while Ethereum saw a negative net flow of $8.8 million.

Source: Artemis

Factors Driving SOL’s Dominance

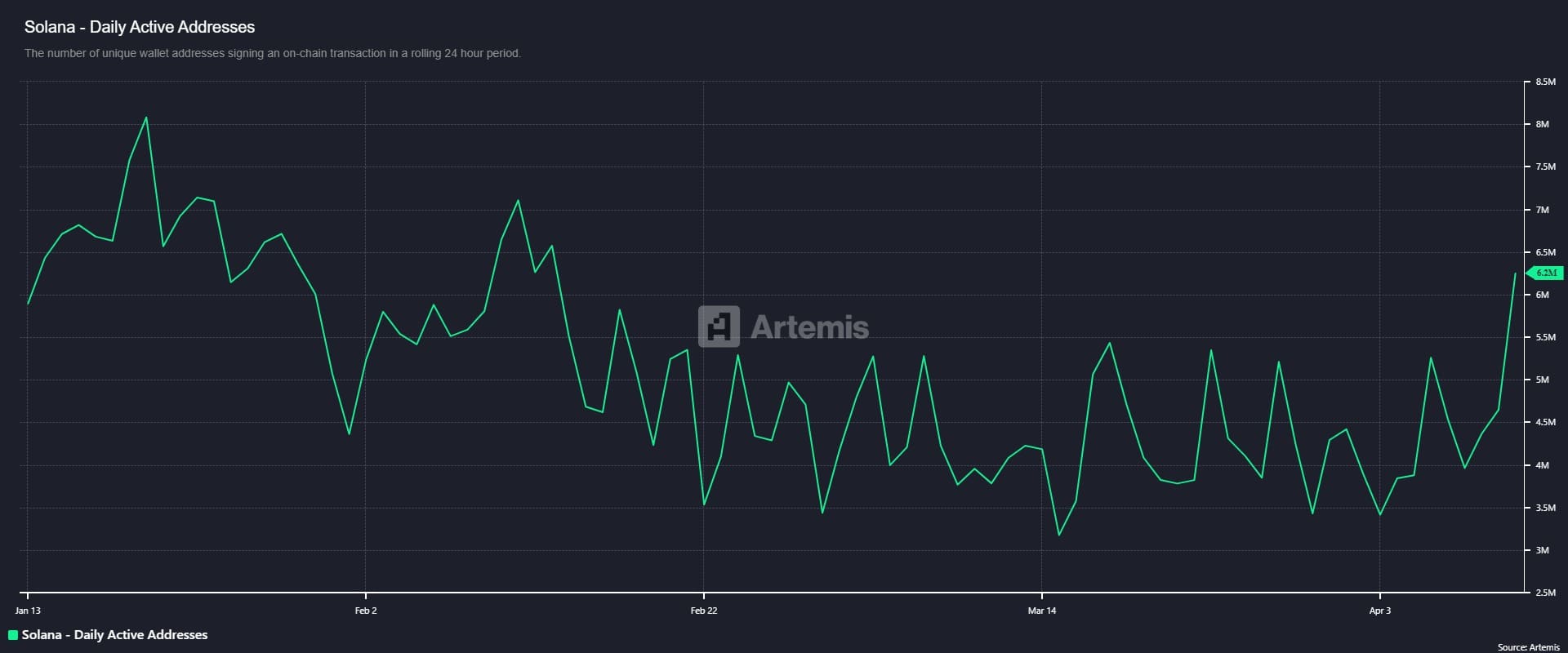

Solana’s market share growth is fueled by increased on-chain activity, with Daily Active Addresses reaching 6.2 million, the highest since February.

This surge signifies growing market interest, as more users engage with the network, driving up demand for SOL.

Source: Artemis

Solana’s daily transactions have increased to 96.1 million, showcasing the network’s growth and usage.

Additionally, the stablecoin supply on Solana has reached $12.6 billion, indicating rising demand and potential value growth for SOL.

Source: Artemis

Positive Market Response

The market has reacted positively to Solana’s recent activities, with spot traders resuming buying after a brief selling period.

In the past 24 hours, spot traders have purchased $9.28 million worth of assets, boosting overall sentiment.

Source: CoinGlass

With continued bullish on-chain activity and spot trader accumulation, Solana is poised for further growth and a potential rally.

sentence: Please make sure to double-check your work before submitting it.