Reasons to Trust Us

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

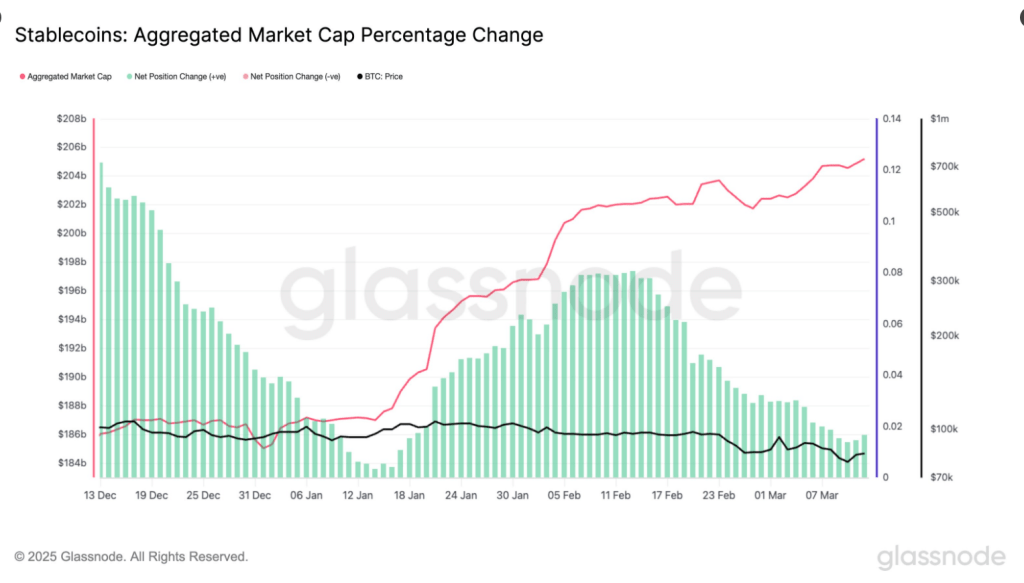

In the beginning of 2025, there was a notable increase in the stablecoin market, with a total supply growth of $20 billion. The total supply now stands at nearly $205 billion, marking a 10% increase from January. This surge, as per data from Glassnode, follows a decline in late 2024 when the stablecoin supply dropped from $187 billion to $185 billion.

Further Reading

Strong Rebound for Stablecoins

Stablecoins such as USDT and USDC play a crucial role in cryptocurrency trading, often serving as a safe haven for investors waiting for opportune moments to invest in assets like Bitcoin. The recent increase indicates a surge in investor interest, particularly after a slowdown last year.

Since Jan 1, the aggregate #stablecoin supply has increased by $20.17B (+10.9%), now reaching more than $205B.

For comparison, the December peak clocked in at $187B but the supply actually contracted in the last two weeks of 2024 and dropped to $185B by January 2025. pic.twitter.com/gQbdMEDisb

— glassnode (@glassnode) March 13, 2025

Given the previous decline, this resurgence is particularly significant. Throughout 2024, the market witnessed a decrease in stablecoins; however, this trend has now reversed. While historical patterns suggest a potential impact on Bitcoin’s price, it remains uncertain if this uptick will result in increased cryptocurrency purchases.

Bitcoin Investors Keeping a Close Eye

An increasing stablecoin supply often signals a bullish trend for Bitcoin. Historically, Bitcoin’s price has risen in correlation with the growth of stablecoins. The logic behind this is simple: more stablecoins mean more potential capital waiting to enter the market.

Some analysts speculate that this fresh influx could drive Bitcoin’s price higher. However, not all stablecoins are used for trading purposes; many are held for remittances, payments, or as a hedge against inflation, especially in regions with volatile local currencies.

As of today, the market cap of cryptocurrencies stood at $2.65 trillion. Chart: TradingView

Stablecoin Exchange Holdings Decline by 21%

Despite the overall increase in supply, only 21% of stablecoins are currently held on exchanges. This represents a significant drop from 2021 when over 50% of the supply was available for immediate trading, as reported by Glassnode. This shift indicates that while new coins are being minted, they are not all being immediately injected into the crypto markets.

Further Reading

This trend could suggest two possibilities: either stablecoins are being utilized more outside of exchanges or investors are awaiting the right moment to enter the market. If the latter scenario proves true, the impact on Bitcoin’s price might be less pronounced than anticipated.

Implications for Bitcoin’s Future

The resurgence in the stablecoin market is generally positive for the cryptocurrency sector. However, it remains uncertain whether this will translate into an immediate price increase for Bitcoin. The utilization of stablecoins has been fluctuating, and additional economic factors will play a role in shaping this development.

At the time of writing, Bitcoin was trading at 82,264, down 1.1% and 6.9% in the daily and weekly timeframes.

Featured image from Warwick Business School, chart from TradingView