Reasons to Trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

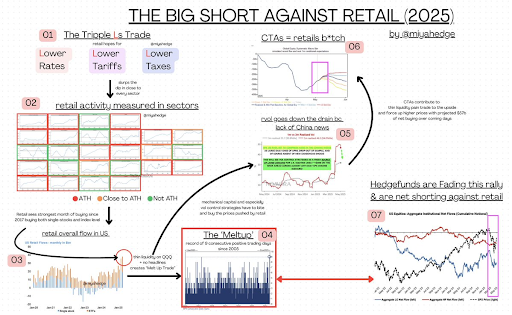

Market analyst Miya has put forth an intriguing theory on the potential for Bitcoin’s price to reach $110,000 by year-end. She discussed current macroeconomic conditions and how they could favor Bitcoin in the long run.

Reasons Behind the Predicted $110,000 Bitcoin Price

In a detailed analysis titled ‘The Big Short against Retail,’ Miya forecasted Bitcoin reaching $110,000 by the end of the year. She also anticipated the S&P 500 dropping to 4,700. Miya suggested that the stock market is heading towards a challenging period, leading to lower levels on the S&P 500 but a promising outlook for Bitcoin.

Further Reading

Essentially, Miya believes that any potential stock market downturn could benefit Bitcoin, as investors seek it as a safe haven. She noted the looming macroeconomic challenges that might trigger a stock market crash. These insights were shared as she commented on the recent consecutive green days in the stock market and why she expects this trend to reverse soon.

Miya highlighted that Donald Trump has made significant commitments to the market related to lower rates, tariffs, and taxes. These commitments are expected to materialize, with market participants factoring them in as certainties. A rate cut is anticipated in June, and discussions between the US and China could lead to reduced tariffs, potentially followed by tax cuts.

As a result, the stock market has experienced a prolonged uptrend, and retail traders have profited from buying opportunities. Nevertheless, Miya cautioned that the market’s strength may be deceiving and could unravel soon, with Bitcoin standing to gain from any market downturn.

Anticipated Stock Market Downturn and Bitcoin Surge

Miya pointed out that the current belief in perpetual market growth gives retail investors a false sense of security, evident in their $57 billion bid on top of accumulated shares. However, she warned that this facade could crumble soon, particularly with the looming “containership recession trade” hitting the US within days. Bitcoin is expected to act as a hedge in such macroeconomic conditions, potentially leading to a surge in its price.

Further Reading

Miya elaborated on the distorted earnings of the ‘Magnificent 7’ in the recent season, deeming them unreliable indicators of a robust market. She also pointed out that TMT firms producing physical hardware tend to experience impacts in their second-half capital expenditures following first-quarter results, indicating that the effects of tariffs are yet to fully manifest.

At the time of writing, Bitcoin is trading around $96,500, reflecting a more than 2% increase in the past 24 hours, according to data from CoinMarketCap.

Featured image from Pixabay, chart from Tradingview.com