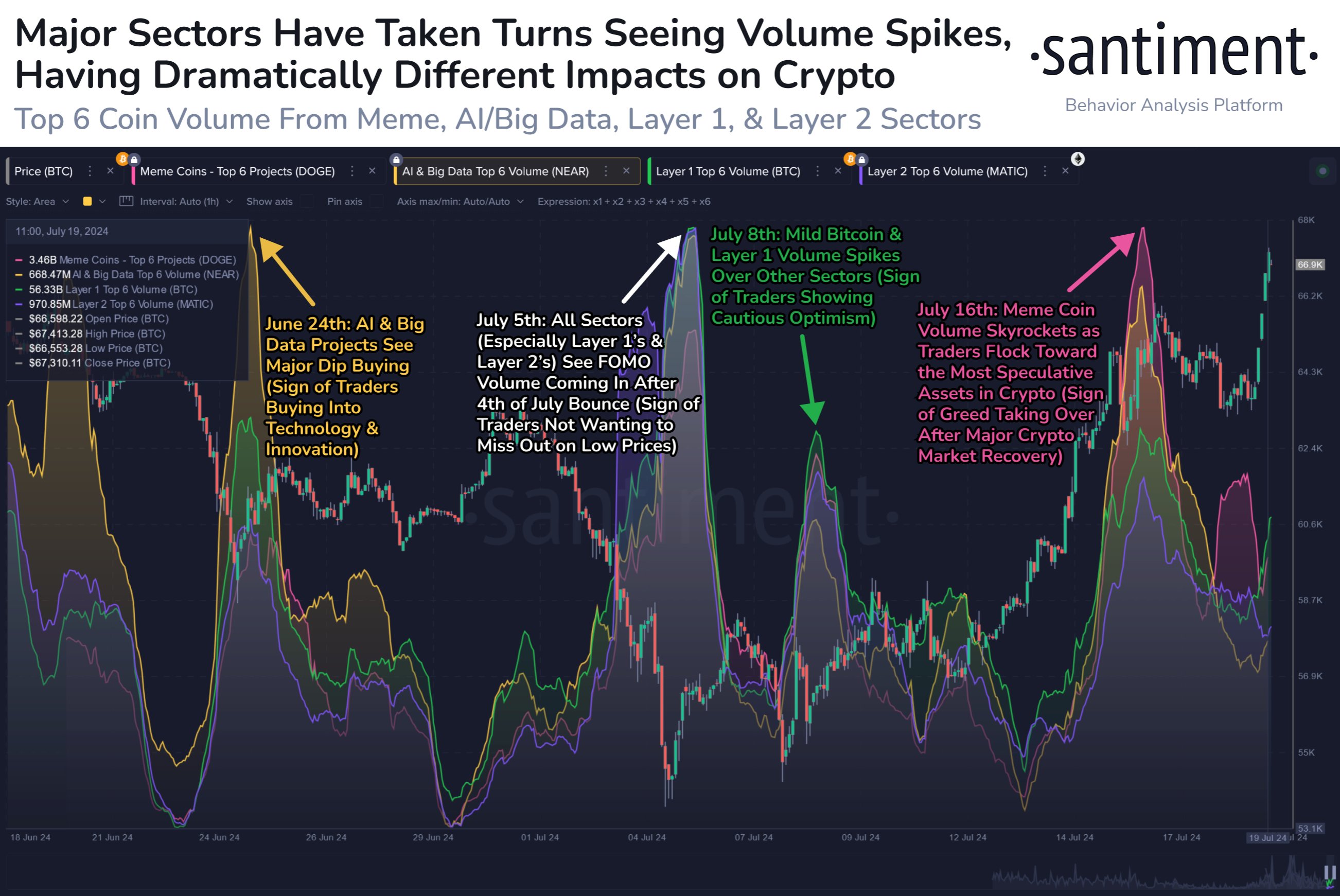

Analytical firm Santiment notes that a surge in volume within a particular crypto sector has historically foreshadowed broader market rallies over the past month.

Santiment is monitoring volume spikes across various crypto sectors to identify potential indicators of future price surges.

The firm attributes the beginning of the current crypto rally to July 8th, when traders started investing in Bitcoin (BTC) and layer-1 projects.

“Recent volume spikes in different sectors:

– Increased volume in Bitcoin and layer-1 assets precedes future crypto gains.

– Increased volume in AI (artificial intelligence) and Big Data coins remains neutral.

– Increased volume in memecoins signals potential market peaks.”

According to Santiment’s analysis, volume surges in Bitcoin and layer-1 projects indicate cautious optimism among traders. Conversely, a sharp increase in memecoin volumes suggests greed prevailing following a significant market recovery.

Regarding Solana (SOL), Santiment anticipates the Ethereum (ETH) competitor to sustain its upward momentum as long as traders remain skeptical of its performance.

“The patient Solana supporters have seen a 33% price breakout since July 4th. The uptrend is driven by skepticism surrounding SOL.

Until FOMO (fear of missing out) supersedes FUD (fear, uncertainty, and doubt), a $200 SOL price target is highly achievable soon.”

Stay Informed – Subscribe to receive email alerts directly to your inbox

Monitor Price Movements

Follow us on X, Facebook, and Telegram

Explore The Daily Hodl Mix

Generated Image: DALLE3