The performance of Bitcoin can fluctuate significantly on a monthly basis, influenced by investor sentiment towards the market. Analysts and investors often analyze historical data to predict the future movement of the cryptocurrency. As August comes to an end, investors are eagerly anticipating September in the hopes of better outcomes.

Bitcoin’s August Performance

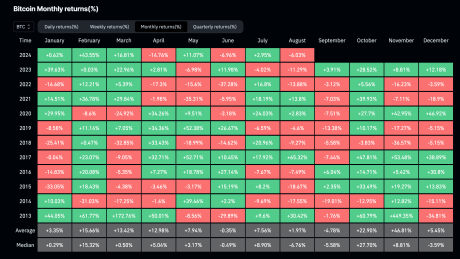

Despite a strong start, Bitcoin experienced multiple crashes in August, causing a 30% drop in the first week. This led to a market-wide decline, impacting altcoins as well. While there has been a partial recovery in the Bitcoin price since then, it remains below its initial level. Coinglass data shows a 6.03% decrease in the Bitcoin price for August.

The current performance aligns with the historical trend of Bitcoin having more negative months than positive ones. Out of the 12 years of data available since 2013, Bitcoin has closed August in the green only four times.

Historically, August tends to be positive for Bitcoin during bull markets, as seen in 2017, 2020, and 2021. However, September has historically been a more challenging month for Bitcoin, with negative returns in 8 out of 11 years.

Predictions for September

Following a weak performance in August, there are mixed expectations for September. While some anticipate a reversal of fortune, others caution against overly optimistic views. Analysts like @btc_charlie emphasize the negative historical trends of September when making investment decisions.

Featured image created with Dall.E, chart from Tradingview.com