Reasons to Trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Despite recent heavy selloffs, Bitcoin is currently holding above $100,000, trading around $103,700. Signs of exhaustion are starting to surface, especially in the past 48 hours.

While long-term indicators point towards a bullish continuation for Bitcoin, short-term models suggest a breakdown in bullish strength as the cryptocurrency nears the critical $100,000 support zone.

Related Reading

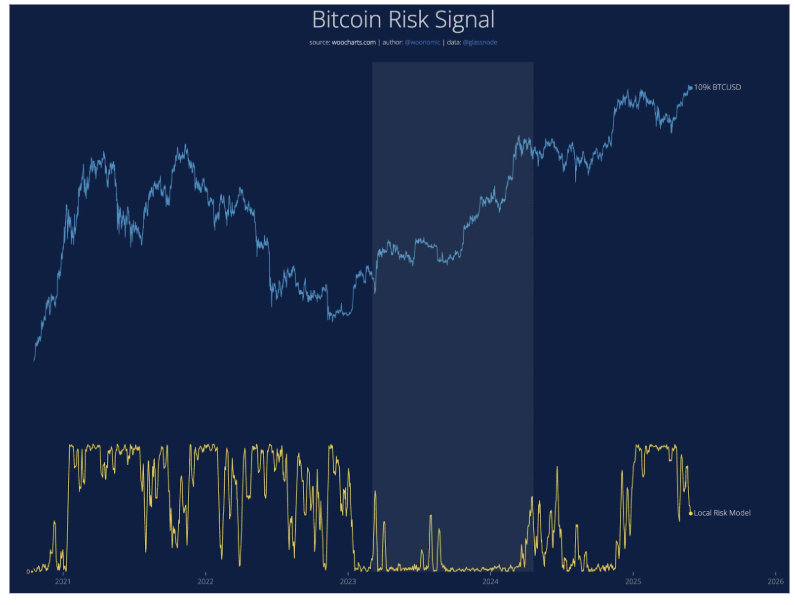

Popular crypto analyst Willy Woo has shared both good and bad news based on Bitcoin’s current technicals.

Good News: Bullish Long-Term Signal Intact

The declining risk reading indicates a low-risk environment for long-term investors, with momentum favoring the bulls as Bitcoin trades above $100,000.

Woo notes that the local risk model is currently in the mid-range and is expected to continue trending downwards, potentially pushing Bitcoin above $114,000 and triggering short position liquidations.

Bad News: Short-Term Caution

Short-term models like the Speculation and SOPR metrics are signaling caution, with weakening rally strength and flat capital inflow in the past three days.

Bitcoin’s price action in the coming week is crucial, with potential for another consolidation period if buying pressure doesn’t strengthen. A bearish pivot could occur if spot buying doesn’t pick up, especially with U.S. markets reopening after a long weekend.

In summary, a quick increase in buying pressure could see Bitcoin surpass $114,000, while failure to do so could confirm bearish divergences and lead to further consolidation.

Related Reading

At present, Bitcoin is trading at $103,700, down by 1.5% and 3.9% in the last 24 hours and seven days, respectively.

Featured image from Unsplash, chart from TradingView