- The total liquidations across the crypto market surpassed $875 million after Bitcoin fell below $100,000.

- Bitcoin long liquidations also surged to a record high of $416 million.

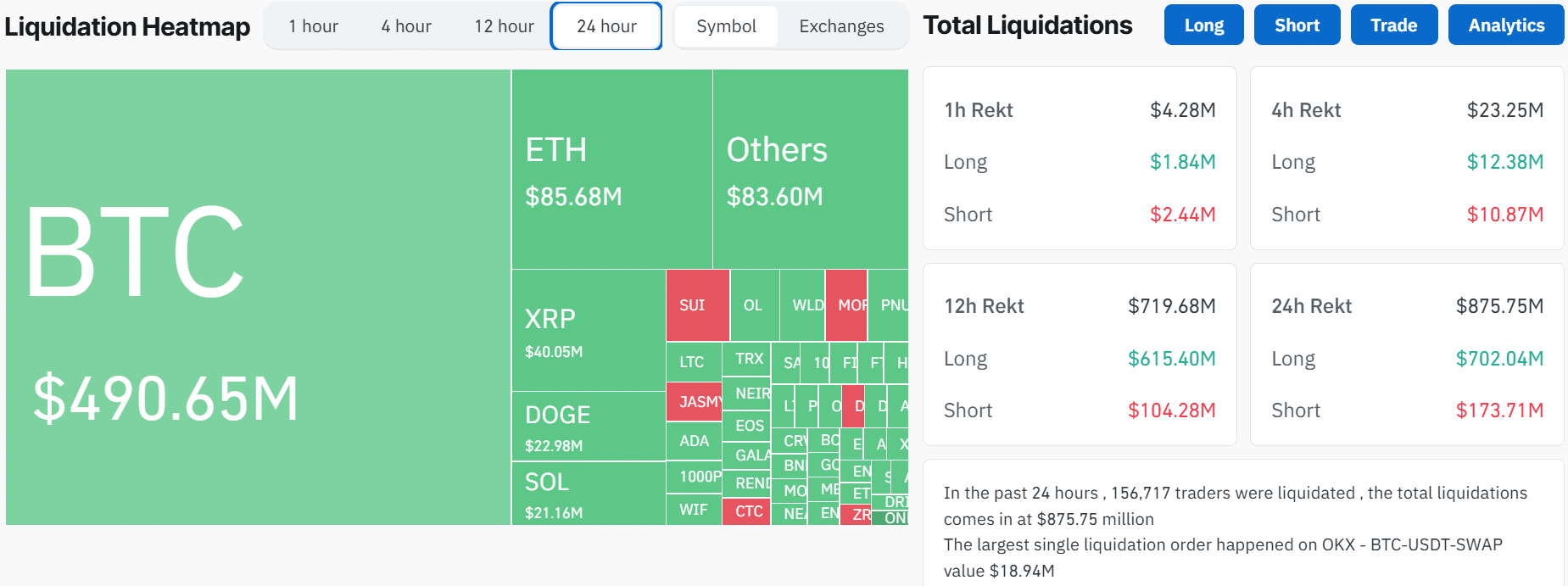

The cryptocurrency market experienced a significant increase in liquidations within the past 24 hours, resulting in the elimination of over $875 million in leveraged long and short positions. This marks the highest volume of liquidations since 2021.

According to Coinglass data, long liquidations amounted to $702 million, while short liquidations stood at $173 million, affecting more than 157,000 traders.

Source: Coinglass

Traders who were betting on Bitcoin gaining further suffered the most losses, with long BTC liquidations reaching $416 million. These positions were closed following a sudden spike in volatility that caused the price of Bitcoin to drop from above $100,000 to $92,000 in less than four hours.

Altcoins also experienced a slight increase in volatility, with Ethereum fluctuating between $3,600 and $3,900, resulting in $85 million in liquidations. XRP saw the third-highest level of liquidations at $40 million, while Dogecoin recorded $22 million in liquidations.

This sudden surge in liquidated trades and volatility may have been a forced correction due to overleverage causing a market imbalance.

Liquidations surge due to an overleveraged market

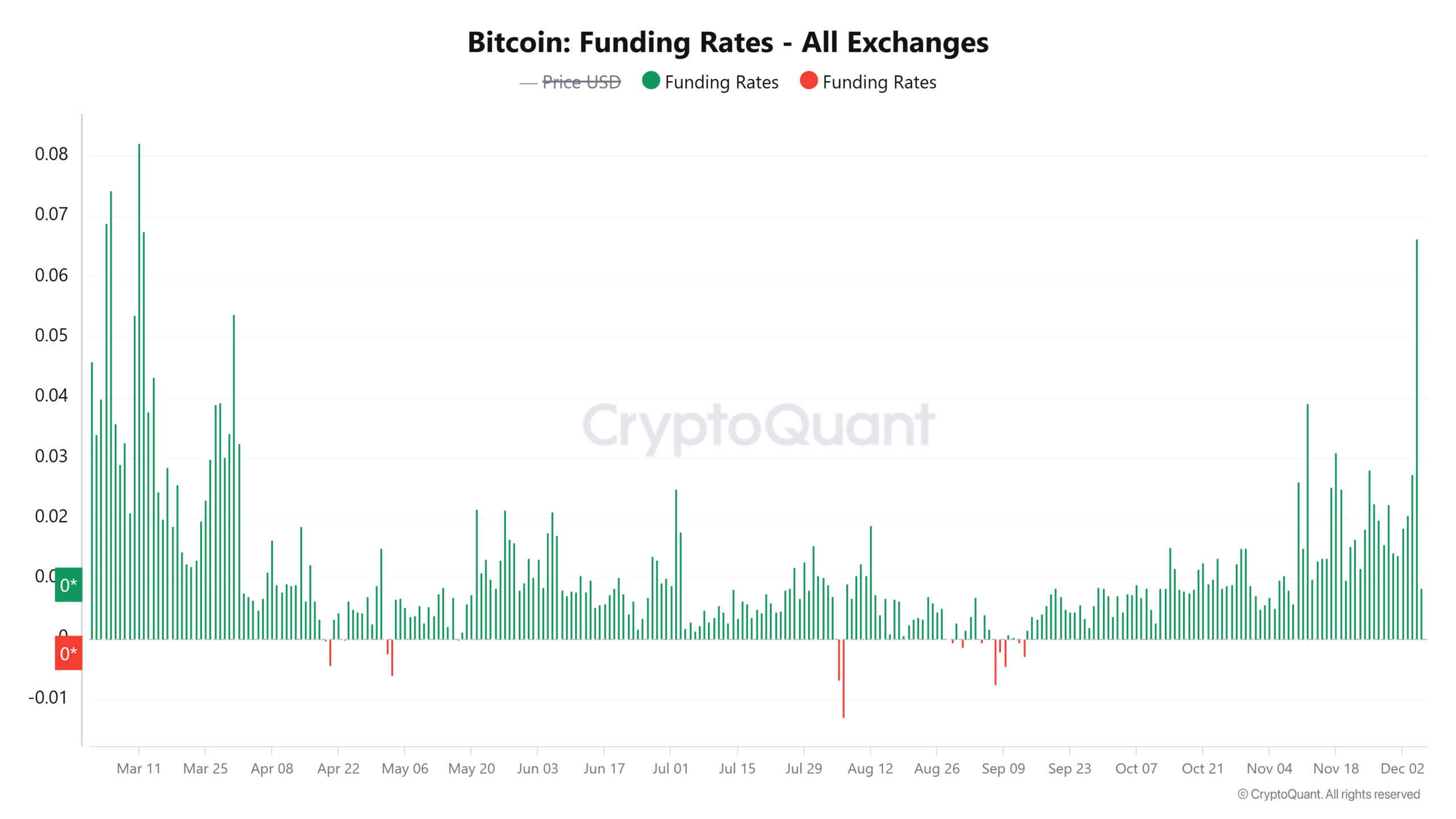

According to CryptoQuant, Bitcoin funding rates hit a multi-month high of 0.0663 on December 5th, indicating an increasing dominance of long positions. Extreme funding rates often precede a sharp move in the opposite direction of what traders anticipate.

Therefore, after an accumulation of long positions, a long squeeze ensued, triggering forced selling and resulting in a decline in funding rates.

Source: CryptoQuant

The estimated leverage ratio clearly indicates the market correction. This metric saw a significant rise to a seven-day high as traders increased their leverage on Bitcoin, followed by a decline as overleveraged positions were closed.

MVRV ratio shows there is still room for more gains

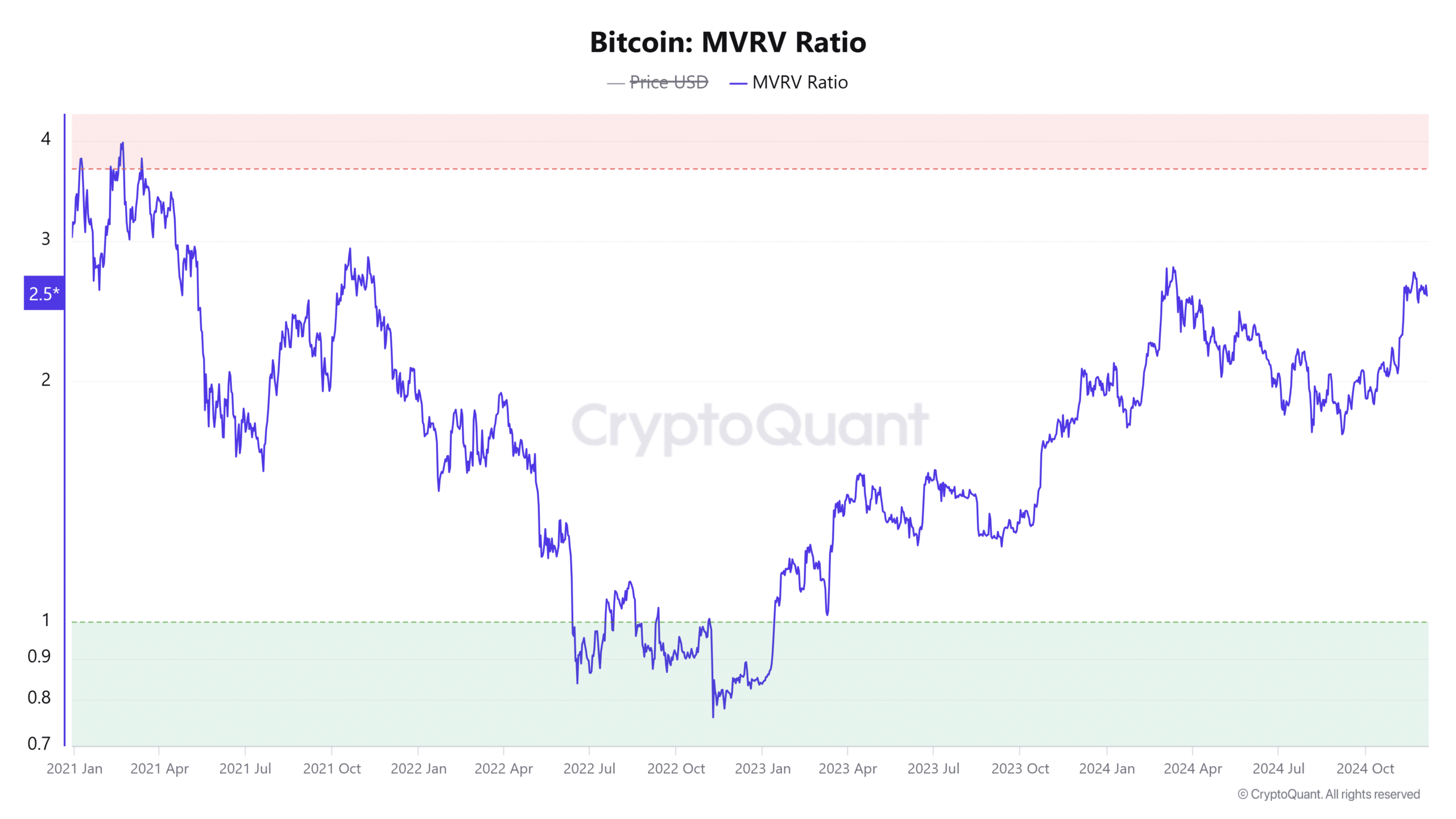

Bitcoin’s market value to realized value (MVRV) ratio suggests that despite the recent correction, BTC has not yet reached its local top.

At present, the MVRV ratio stands at 2.5, indicating that the asset is still reasonably priced. Over the last three months, Bitcoin’s MVRV ratio has risen from 1.72 as profitability for holders increased.

Source: CryptoQuant

A surge in the MVRV ratio above 3.5 will signal that Bitcoin has reached a local top. Traders should monitor this metric for a potential further increase to overvalued levels.

statement as: “Please provide a rewritten statement for the given text.”